Stock average price formula

Volume-Weighted Average Price Price x Volume Volume. So Id state XXX Average Cost of holding is 13350665 and for ZZZ is 2200400 being the latest date for a stock with a positive purchase qty.

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

We can calculate the stock price by simply dividing the market cap by the number of shares outstanding.

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

. After doing so they must calculate the product of the price and volume for the data. Time to achieve Excellence in ExcelIn this video you will learn how to calculate the average price in Excel. Lets calculate what their average selling price was.

Top 10 Penny Stocks Top 50 Stocks Trade Alert 742 in 7 Days. Next we add up the number of units sold which comes out to 43000. For the above formula investors need to accumulate the price and volume data of a specific stock.

To find the weighted average you multiply the number of shares by the price you paid for that transaction then add the number of shares you paid by the per-share price in your next transaction s and divide that number by your total shares. Find a Dedicated Financial Advisor Now. Using our tool you can calculate the stock average price for your trades First Trade Current Quantity Current Average Price Second Trade New Quantity New Price.

Ad Ensure Your Investments Align with Your Goals. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost. If the stock price recovers to the 1st purchase price of 5000 the total value of the investment will become 1000000 from an initial investment of 600000.

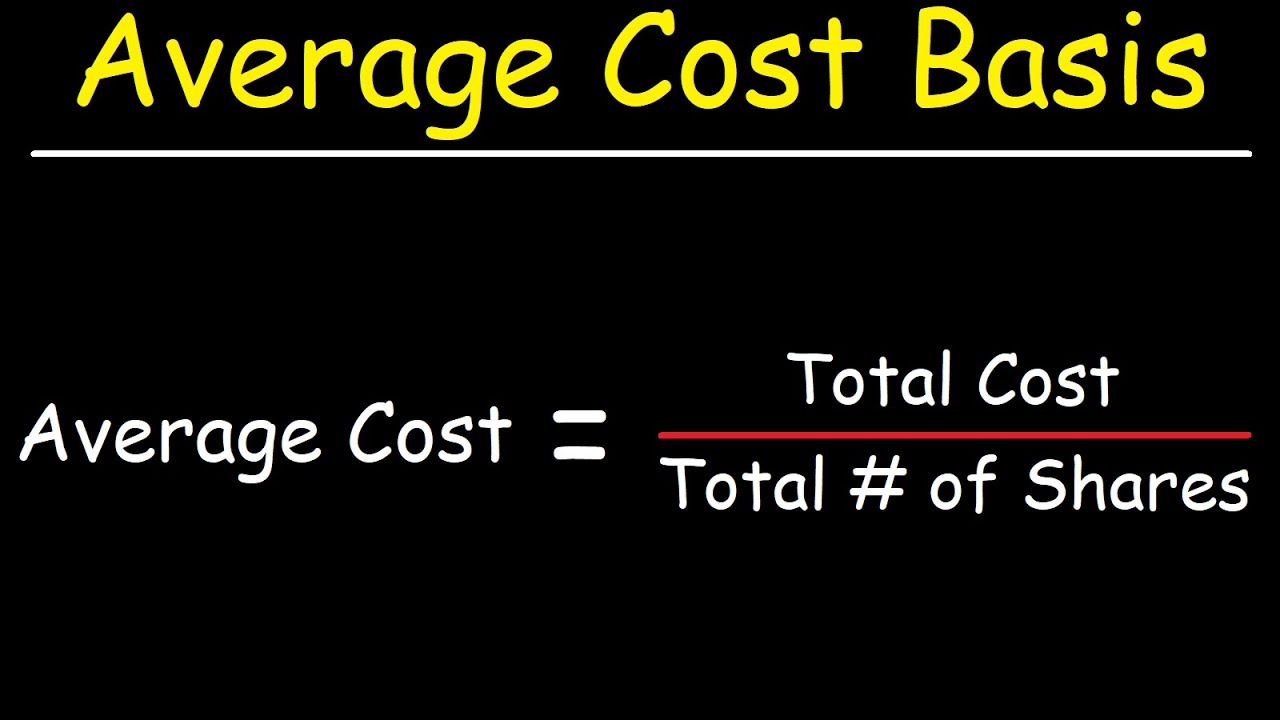

To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858. Calculate Your Average Cost Divide the total purchase price by the total number of shares to calculate the average price of the position. The stock average calculator helps to do all the calculations easily and fast.

Here are the steps to calculate a weighted average trade price. In order to calculate your weighted average price per share you can use the following formula. 10000 250 2500000 13000 220 2860000 20000 180 3600000 The total amount of revenue earned by the company was 8960000.

The average price of shares equals the total buying price divided by the total number of shares bought. Searching for Financial Security. Recently reported a dividend payment of 250 per share.

List the various prices at which you bought the stock along with the number of shares you acquired in each transaction. New Waited Average Price stok price 10 200 stock 10 new1 Then sold 7 3 so you got a newStock with stock waited average price is still new1 after that you bought 2 250 so waited average price will be now. The higher the stocks price rises above the average price of your position the more profit happens.

Lets say you buy 100 shares at 60 per share but the stock drops to 30 per share. Lets now apply the formula for stock valuation in an example. This is part of a video series and dives deep i.

Average unit price is calculated by dividing the total revenue or net sales amount by the number of items sold. Average traded price is what buyers have paid for one. Cost Basis Average cost per share 4858 x of shares sold 5 24290.

Reflects the cost of equity. Stocks Under 1 2 5 10. Volume 0 300000 500000.

Consider the following information. In other words we can stay that the Stock Price is calculated as Lets now think about why we can calculate it this way. If you buy a stock multiple times and want to calculate the average price that you paid for the stock the average down calculator will do just that.

The Market Cap aka Market Capitalization reflects the market value of the equity of the company. In this example divide 4525 by 550 to get an average price of 823 per share. Analysts estimate its cost of equity to be 85 and do not expect the company to ever change its dividend payout policy.

This changes the cost basis from 5000 to 3000 which is a difference 2000 or 4000. You then buy another 100 shares at 30 per share which lowers your average price to 45 per share. The volume-weighted average price formula is as below.

Our Financial Advisors Offer a Wealth of Knowledge. What Is Average Traded Price. New Waited Average Price newStok new1 2 250 newStock 2 new2 Hope this help someone.

Average Cost per share Total purchases 2750 total number of shares owned 5661 4858. First lets calculate the total amount of revenue the company earned. In words this means that you multiply each price you paid by the number of shares you bought at that.

Wacc Formula Definition And Uses Guide To Cost Of Capital

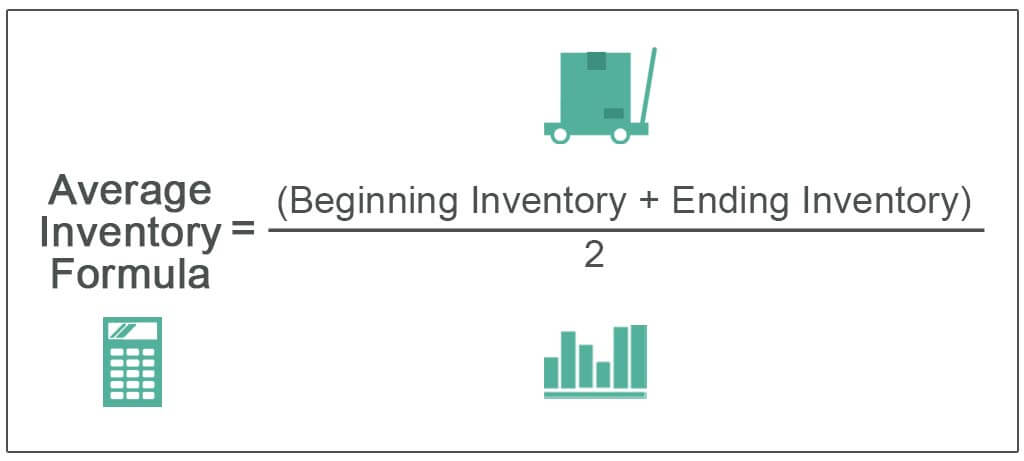

Average Inventory Formula How To Calculate With Examples

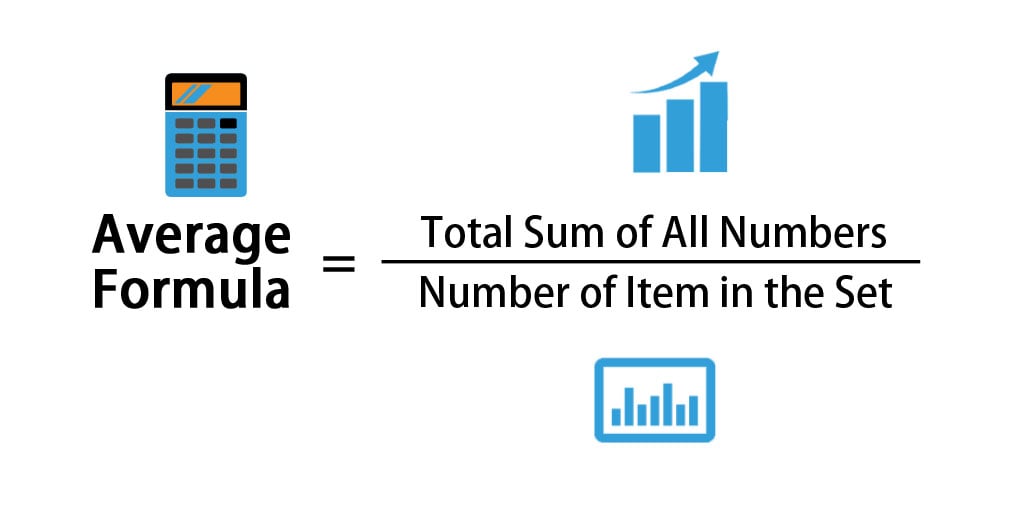

Average Formula How To Calculate Average Calculator Excel Template

Stock Average Calculator Cost Basis

Weighted Average Cost Accounting Inventory Valuation Method

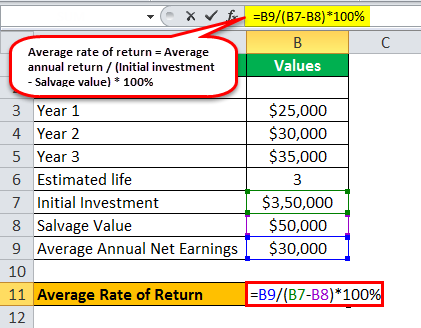

Average Rate Of Return Definition Formula How To Calculate

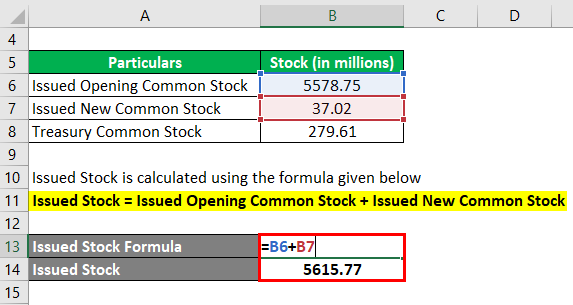

Shares Outstanding Formula Calculator Examples With Excel Template

How To Calculate Weighted Average Price Per Share Fox Business

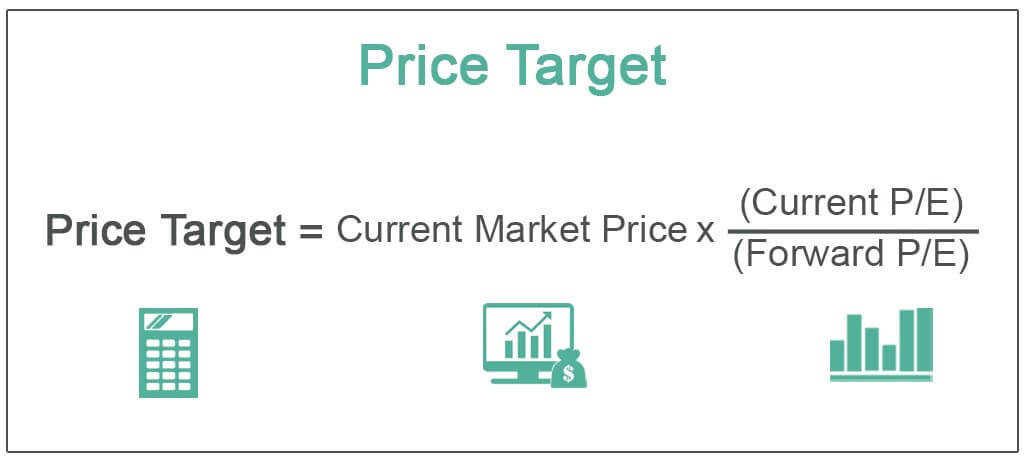

Price Target Definition Formula Calculate Stocks Price Target

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

Stock Average Calculator Cost Basis

Average Inventory Formula How To Calculate With Examples

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

Dollar Cost Averaging Dca Investing Strategy In Stock Market

Cost Of Preferred Stock Rp Formula And Calculator Excel Template